You know how some people put off getting a health physical because they’re afraid of what they might find out? It turns out ignoring weird lumps, persistent aches and unexplained rashes won’t make them go away. And not tending to them is a lousy strategy for long term health. The same goes for credit scores.

It’s better to know, and act

Ignoring a potential credit problem is not a good plan for long-term financial health. Paying attention and tending to your credit is a much better strategy. There are a lot of reasons your credit score may not be as high as you’d like or need for financial peace of mind. Maybe you weren’t as conscientious with paying bills on time as you should have been. You might have a short-sale in your credit history or a medical bill that went to collections. No matter the reason, the fact is, life happens, and when it does it can have a negative impact on your credit score.

“Credit scores are an incredibly important part of every American’s life, but many don’t understand that importance,” shares Michele Johnson, executive director of Money Management International in Las Vegas.

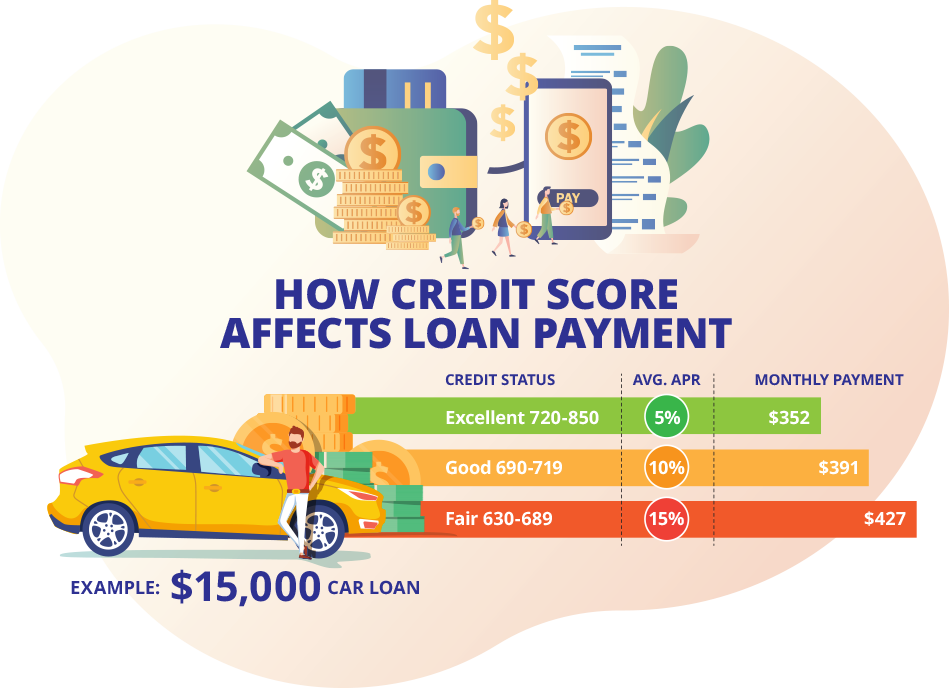

Say you want to buy a home or a car — your credit score matters. Looking to finance a new refrigerator or furnace — they’ll check that score. Perhaps most importantly, your credit score affects the interest rate you pay for all of these things. A small improvement in your credit score could save you thousands of dollars over the life of the loan.

“After the housing crash, mortgage companies changed the way they provided credit,” Michele explains “If your credit isn’t as good as it should be, you may still get the house, but you’ll be paying more for it through a higher interest rate.”

She adds that some employers and insurance companies will also pull credit reports to evaluate how responsible an applicant is with their money. Poor credit is a lousy way to derail a career, so let’s take a look at managing your score.

Who’s got an eye on your credit

FICO is the one you’re probably most familiar with. Developed by the Fair Isaac Corp. more than 25 years ago, it pulls from each major recording agency (Equifax, Experian and TransUnion). FICO uses a mathematical formula to predict how likely you are to repay creditors if they decide to grant you credit. It is also used to set the interest rate you pay. FICO scores range from 300 to 850 – a score of 720 or above puts you in the excellent credit range (read: low risk for lenders).

While FICO doesn’t reveal precisely how scores are calculated, it does give guidelines about what factors matter most for scores.

- Payment history (35% of your score): This concerns whether you’ve historically paid your bills on time. Late payments can ding your score, although 30 days late isn’t as bad as 60, etc. A bankruptcy or accounts in collections could also hurt you.

- Amount of debt relative to credit limits (30%): This is how much of your available credit you are using — the less the better for your score.

- Age of credit (15%): This refers to how long you’ve had credit and the average age of your credit accounts.

- Recent applications for credit (10%): A so-called “hard inquiry” (when you agree to a credit check when applying for new credit) can nick your score for up to six months.

- Whether you have more than one type of credit (10%): Having both installment loans (those with level payments, like a car loan or mortgage) and revolving credit (like a credit card) can help your score.

Simple math shows that paying on time and keeping balances low accounts for about two-thirds of a FICO score.

VantageScore is a competitor to FICO and used by lenders, landlords and credit card issuers to evaluate credit worthiness. It follows the same score range as FICO, except it uses terms of influence rather than percentages.

- Payment history is “extremely influential.”

- Age and type of credit and the percentage of credit used are “highly influential.”

- Total balances and debt are “moderately influential.”

- Recent credit behavior and debt are “less influential.”

“Both use much of the same information, but VantageScore is used more for people who don’t have an established credit background,” Michele explains.

For people just getting started, Michele recommends getting a small credit card, perhaps from a department store. “Use it but pay it off every month when you get the bill,” she says. “That way it’s not costing you anything in interest, but you are demonstrating to the reporting bureaus that you’re responsible.”

Have a looksee, but just once a year

You can get a free copy of your FICO credit score once a year by visiting AnnualCreditReport.com. Some credit card companies like Bank of America and Citibank give their customers free FICO scores. Discover has also made FICO scores based on TransUnion credit reports free for anyone.

There are subscription-based credit monitoring services like Experian that track your score and alert you to changes in real time but Michele doesn’t recommend them. “It’s not really necessary to check your score every month as it typically won’t change that much in that time,” she says. “Rather than paying $25 a month to track your score, put that money toward paying down your credit cards faster.”

Michele does recommend checking at least annually and possibly every six months if you have a lot of credit activity, like actively paying down cards. “I get my credit report every year on my birthday,” she says. “It costs nothing and it’s good to know where I stand. Most importantly, it lets me know if there’s anything on there that needs to be addressed.”

Let’s get that grade up

If your credit score isn’t where you would like it to be, take some lessons from the credit agency formulas to start improving it. Paying down credit and paying on time are the two most important things you can do.

Michele says there is merit in paying off the lower balances first and then attacking the higher balances. “If you get a bonus, it makes good sense to pay off the lower balances,” she says. “Having at least one card with a zero balance will help your score.”

Michele recommends staying away from credit repair promises as they’re typically scams. “Nobody can legally remove accurate information from your credit report,” she says. If you need help, visit a non-profit credit counseling agency like Money Management International, which has offices in Las Vegas and Reno, and offers a range of financial education and counseling services.

Read: Beware of credit repair

Good credit = homebuying opportunity

Good credit = homebuying opportunity

If you have a credit score that’s 640 or higher, you could be eligible for one of our Home Is Possible down payment assistance programs. Get more information on the programs and then reach out to a HIP-qualified lender to discuss your specific situation. You might be closer to homeownership than you think!