It’s no secret the Las Vegas real estate market has seen more than its fair share of ups and downs in the last decade. Without dwelling on the past, it’s important to remember the area’s bubble—and subsequent burst—in order to put today’s much healthier market into perspective.

“Median home prices in June have increased by 2.9 percent from the previous month to $257,373. That steady growth shows that the market is stable,” said Lily Spencer, a REALTOR® at Urban Nest Realty in Las Vegas. “There’s also lots of new construction going on in the area, which is helping to address the housing shortage.”

If you’re currently shopping for a home, or plan to soon, you need to understand the nature of southern Nevada’s unique real estate environment. “It’s a seller’s market,” said Spencer. “Buyers need the guidance of an experienced real estate professional to help avoid the pitfalls that this kind of market poses.”

Here are four tips to keep in mind to help secure the house you want at a fair price.

1. Get Ahead of The Game Before You Begin

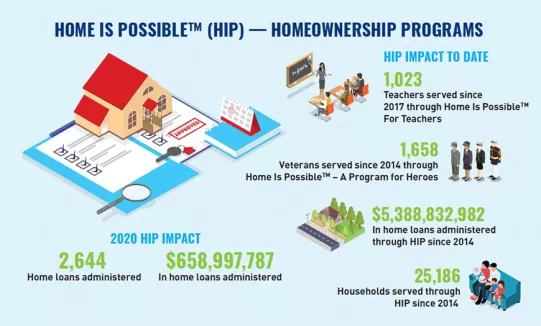

Down payment assistance programs can help homebuyers secure a home. “There’s an excellent program called Home Is Possible, and it’s available statewide,” Spencer said. “Qualified buyers can receive thousands of dollars for a down payment and closing costs on a home up to $510.400—for just living in the home.”

Because homebuyer programs have certain requirements like using an approved lender or meeting credit score minimums, you should research available programs as soon as possible.

2. Be Really Ready to Make An Offer

Homebuyers need to get pre-approved for a home loan to move swiftly, which Las Vegas market conditions call for, and be taken seriously by sellers. “Homes are selling quickly in the resale market,” Spencer said. Especially in a multiple offer situation, not having pre-approval can be detrimental.

3. Get Familiar with Comps

One mistake homebuyers often make is under-valuing a home. What someone wants to pay is often different than what a house is actually worth, especially in a seller’s market. Real estate professionals can share comparables (or comps) to see what similar homes in similar neighborhoods have recently sold for. If an agent has not yet been selected, homebuyers can use tools like realtor.com to get an idea of going prices.

4. Make A Clean, Competitive Offer

Homes priced at $350,000 and below are in especially high demand in southern Nevada. “Buyers need to come in with a strong offer. Often, that means full price,” Spencer said. If you want to come in over asking price to be competitive, be advised that lenders will not lend any amount over the asking price even if the house appraises higher.

A clean offer means having no contingencies like requesting repairs be made (other than electrical or mechanical, which are required by law), or the sale of your current home.

Seizing Opportunity In Las Vegas

According to the Greater Las Vegas Association of Realtors, 87.2 percent of townhomes and condominiums in Las Vegas sold within 60 days, and 83.3 percent of homes sold within the same timeframe in the month of June. The numbers have jumped sixteen and nine percent respectively from just one year ago.

Taking into account how fast properties are selling, Spencer gave this advice: “If you see something you want, you need to buy it on the spot before it’s gone.” Following the tips above will help you be ready in Las Vegas’ fast-paced housing market.