Are you ready to make a move? Turns out, you’re not alone, and we can help. If you’re looking for reasons to consider fall homebuying, we’re creepin’ it real and giving you a snapshot of the Nevada housing market — as well as offering insight about rising interest rates and ways to get bonus money.

Lights that flicker for no reason, walking through a room and finding an unexplained cold spot, pickles on peanut butter sandwiches: spooky.

Rising interest rates: Totally not spooky!

Yes, the Fed seems to be continuing a slow and steady increase in interest rates into the fall, but at the moment, this seems to be at pace with our booming economy. Low unemployment is seen as the trigger, meaning a campaign to steadily increase interest rates will hopefully help us avoid that truly scary word: inflation.

And this trend doesn’t look like it’s going away any time soon. According to Kiplinger, “…the Fed is not likely to deviate from its once-a-quarter rate hike program until the second half of 2019.”

So what does all of this mean for you? This fall you should totally dress up as a homebuyer and shop for a home in Nevada!

Un-boo-lievable Reasons to Consider Fall Homebuying

While spring and summer are seen as the typical seasons for home shopping, you’re a rebel (we like that about you). We encourage you to buck the trend and find your new home this fall.

Even Zillow recognizes you’re on to something. They just published this post talking about how fall is an ideal time for home shopping. Among the reasons: better deals due to inventory that stays on the market longer, less competition in general and motivated sellers who want to be out of their homes before they expend excess energy hanging holiday lights!

You may also like: Yes, you can buy a house. Even in this market.

So what does the market have to say about all this talk of fall homebuying?

Turns out, quite a bit!

The Nevada Housing Market at a Spooktacular Glance

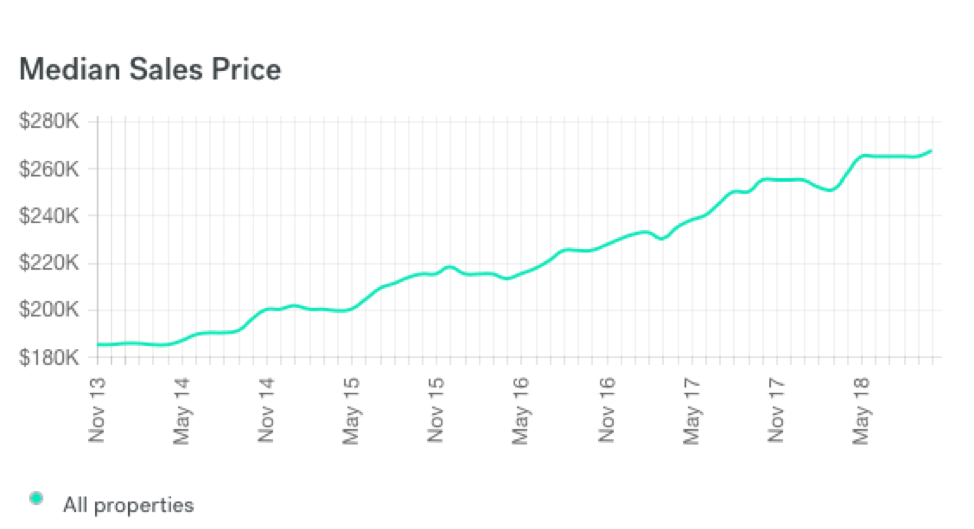

Southern Nevada

According to RealtyTrac.com, Las Vegas has:

- nearly 5,900 homes currently for sale

- a median list price of $288,000 (non-distressed home)

- a median sale price of $258,000 (non-distressed home)

Trulia.com shows Las Vegas market trends with a rosy selling picture: an increase of $14,000 (6%) in median home sales over the past year. The average price per square foot for this same period rose to $161, up from $138.

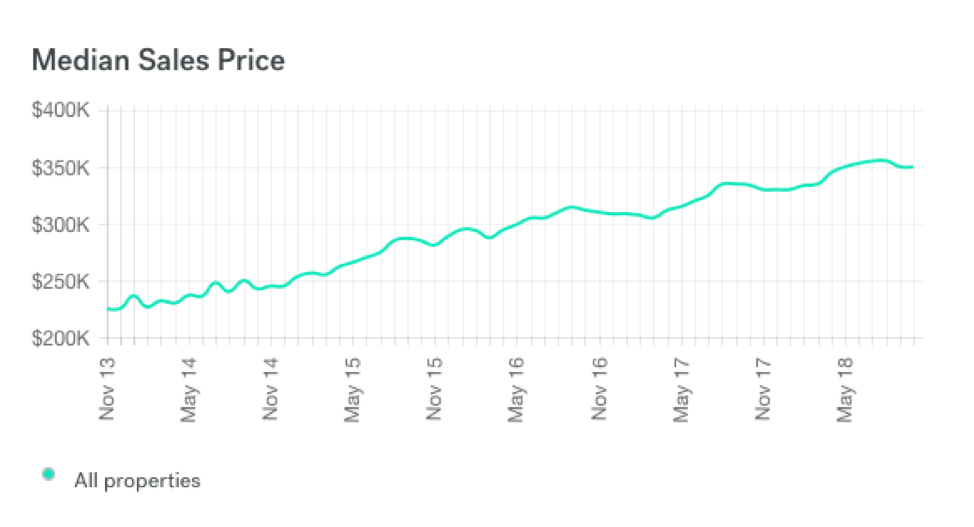

Northern Nevada

According to RealtyTrac.com, Reno has:

- more than 1,400 homes currently for sale

- a median list price of $385,000 (non-distressed home)

- a median sale price of $350,000 (non-distressed home)

Trulia.com research shows a Reno market trending in the positive for sellers: an increase of $17,000 (5%) in median home sales over the past year. The average price per square foot for this same period rose to $226, up from $201.

Trick or Treat Yo’self

Buying a home this fall is not just witch-ful thinking. Current market conditions make our family of Home Is Possible programs even more valuable to eager buyers than they were back when we created them in 2014. We start by offering extra moolah for that new house and pile on other goodies for special groups:

- If your family’s annual income is $98,500 or less, and the home you want to buy costs less than $400,000, Home Is Possible can help you with bonus money of up to 5% of the loan value, usable for down payment and closing costs and forgivable after three years (if you stay in your home).

- If you’re a veteran or active military personnel, you could secure a below-market fixed interest rate with the Home Is Possible for Heroes program.

- If you’re a licensed K-12 teacher in Nevada, you could receive $7,500 through the Home Is Possible for Teachers program, as well as a below-market fixed interest rate 30-year loan.

- And if you’re a first-time homebuyer or qualified veteran, you could save about $2,000 a year with the Home Is Possible Mortgage Credit Certificate program.

You may also like: NHD Recognized with US Bank Award

Let’s Get This Party Startled

If fall homebuying is in your future, we’re here to help. Get started by finding a HIP-qualified lender and real estate professional who can help you get the most bang for your homebuying buck.

Happy house haunting — um, we mean, hunting — everyone!